CarTrawler Car Rental Market Monitor: Q2 2025

Jul 7, 2025

Travel’s Uneven Summer Season

The summer travel season, which typically signals a universal surge in demand for a variety of travel products and services in northern hemisphere markets, is shaping up to be more uneven this year.

Recent disruptions in the Middle East have dampened west-to-east travel, but the chief culprit appears to be a softening in inbound U.S. travel demand, exacerbated by new government policies. International tourists to the U.S. are canceling trips in response to recent policy changes, including new tariffs, travel restrictions, and stricter immigration enforcement. Because of this, research firm Tourism Economics now projects a 9% decline in international arrivals for 2025, compared to its forecast increase of 9% at the beginning of 2025.

While inbound travel to the U.S. is softening, demand may be buoyed by interstate travel. The share of American consumers planning to go on a domestic vacation in the next six months rose to 42% in May, according to New York Times reporting. Bank of America’s 2025 Summer Travel and Entertainment Outlook showed that 70% of Americans who are planning a trip of any kind are opting for domestic travel. Road trips are being favored, with California, Florida, New York, and Texas featuring as top destinations.

This supports projections for increased car rental volume within the U.S. during the summer travel period. Skift found that U.S. short-term lodging and car rental performance both grew as of March, and our platform data indicates that domestic demand is stable, showing mild year-over-year growth in the second quarter.

U.S. inbound travel is softening, but domestic demand remains strong

Surging Rental Demand in Southern Europe

Travel demand elsewhere, particularly in Europe, remains stable and is counterbalancing the deficit in inbound U.S. travel.

Skift’s latest Travel Health index shows intra-Europe flight searches increased 36% year on year, and searches for “sun and beach” destinations ahead of the summer travel season increased 59%.

This corresponds with CarTrawler car rental booking volume data. According to our platform, the top four pickup destinations in the second quarter were all located on the Iberian Peninsula (Mallorca, Malaga, Lisbon, and Alicante), consistent with the same period in 2024.

Spain and Portugal are not alone among trending destinations this summer. Conde Nast identified Budapest, Salzburg, Innsbruck, Lech, Istanbul, Izmir, Prague, Dubrovnik, Ljubljana, Bar, Kotor, Ulcinj, Bodrum, and Gallipoli as “hot” cities for summer travel.

Bright Spots in EV Adoption

Interest in EVs has not waned, even if purchasing trends have softened recently.

According to the latest CarTrawler consumer sentiment survey across our UK and U.S. customer base, penetration in the electric vehicle (EV) car rental market is still low across both markets. However, the consideration of EVs as a rental option remains high, particularly among younger generations.

Rental booking volumes, however, are catching up to this interest. The percentage of EU customers renting an EV through our platform remained steady at nearly 3% in June 2025. In North America, that proportion rose to almost 6%. While both are short of multi-year highs, they represent relatively consistent or increasing demand compared with Q1. And while analysts are slashing estimates for U.S. EV sales in the coming years as GOP lawmakers and Trump officials roll back tax credits and emissions regulations, the impact on EV rentals may be less pronounced.

In Europe, the influx of EVs from China, particularly from manufacturers like BYD and XPENG, is exerting downward pressure on EV pricing, which will eventually filter into EV rental pricing as fleet composition favors these manufacturers. XPENG’s recent push into European markets with models like the P7 and G9 further underscores this trend toward greater competition and affordability.

Europe and the UK already feature more EV model variety than the North American market, which remains dominated by Tesla. According to our platform’s 2025 year-to-date numbers, Tesla makes up 59%% of all EV and hybrid rentals in North America; the next closest manufacturer is Toyota (22%). The UK market is more balanced, with Toyota (31%), Kia (11%), and Polestar (11%) all well-represented. Europe features a similar split, with Toyota (26%), Cupra (14%) and Renault (13%) emerging as top EV/hybrid brands.

EV Model Percentage by Region

Ways to Pay Proliferate, Led by Mobile Wallets

EVs aren’t the only relatively new technology consumers are embracing; alternative payment methods are also surging.

McKinsey reports that roughly nine in ten consumers in both the United States and Europe report having made some form of digital payment over the past year, with the United States reaching a new high at 92%.

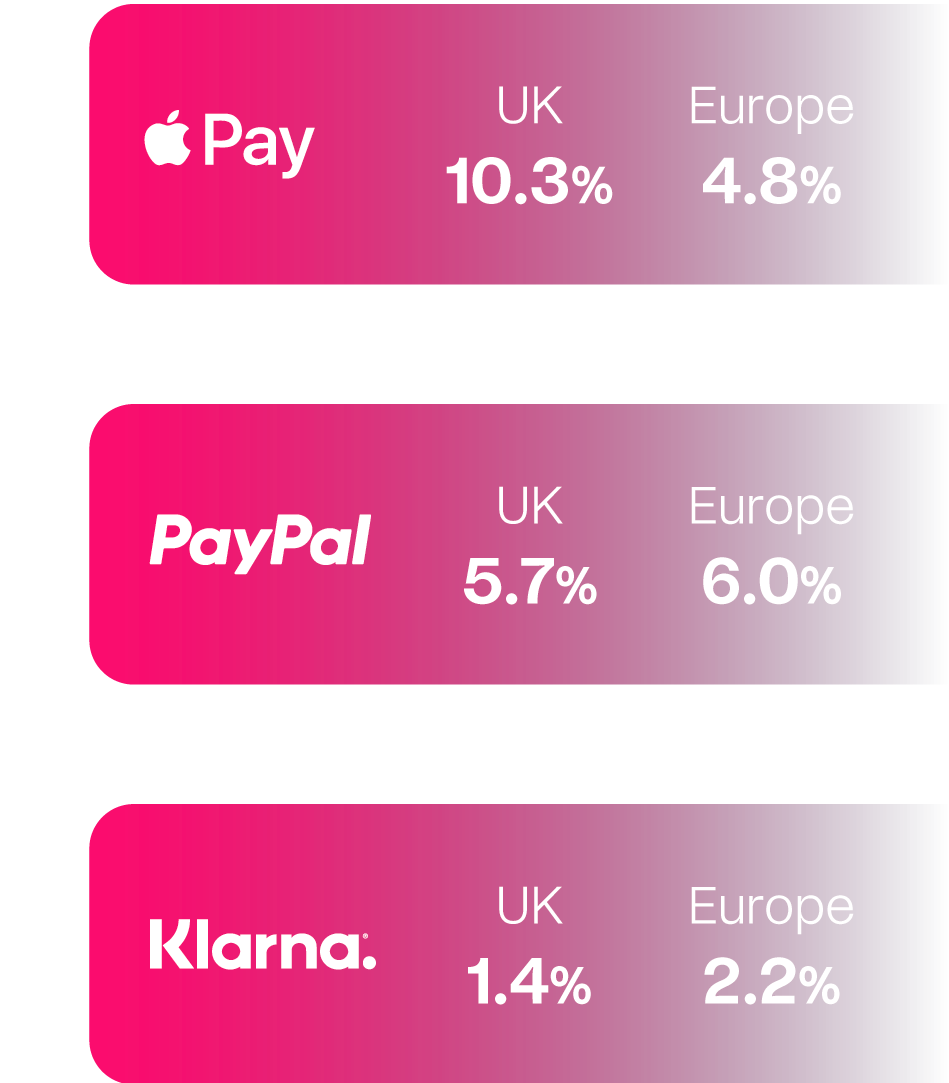

McKinsey also reports that global wallets (e.g., PayPal, Amazon) are the top digital payment methods in Europe (55%) for online transactions. This payment behavior extends to car rental bookings. In the second quarter, PayPal alone accounted for about 6% of total EU bookings on our platform, followed by Apple Pay at almost 5%. Buy now, pay later (BNPL) options are also rising in popularity among European car renters, as evidenced by the steady increase in Klarna usage on our platform in the second quarter. Klarna payments represented 1.8% of all transactions in April, 2% in May and 2.2% in June—all showing a steady increase from 4Q 2024 (1.5%) and 1Q 2025 (1.66%).

However, our data shows that an OEM wallet, Apple Pay, is the preferred digital payment method in the UK for car rental bookings (over 10% in June 2025, compared to PayPal’s nearly 6%). This illustrates not only the rising popularity of Apple Pay in the UK but also underscores the differences in how consumers prefer to pay for car rentals compared to other travel products or online purchases in general. These regional variations also point to a clear opportunity: adapting to local and alternative payment methods can improve conversion, enhance the customer experience, and unlock additional revenue.

On the other side of the pond, Americans still overwhelmingly use credit cards for their car rentals compared to the rest of the world. This is attributable to the “big three” rental suppliers incentivizing that payment method, as well as the fact that most U.S. bookings are reserved online but “post-paid” at the rental counter.

Digital Payment Preferences Among CarTrawler Bookings – June 2025

(% of Total)

Loyalty-Integrated Bookings are Lifeblood

Loyalty programs are an increasingly crucial booking and distribution channel for car rentals

Percentage of Bookings Associated with Loyalty Programs – June 2025

Not all online bookings are made directly with car rental suppliers, OTAs, or travel brands. In June 2025, 58% of all North American rentals made through our platform were tied to loyalty programs, with over 53% of members earning points on their car rentals, a substantial YOY increase. This remains largely a phenomenon of the more mature North American loyalty market, as consumers are often members of multiple programs and more accustomed to earning points on car rentals. Europe (12% earning points) and the UK (3%) continue to lag in loyalty program participation. While relatively few airlines currently support point redemption for car rentals, CarTrawler data from six major global airlines shows redemption rates of up to 20% across their total bookings, signaling a major opportunity for those that do.

The large percentage of bookings originating through loyalty programs in the U.S. signals a substantial opportunity for programs to incorporate car rentals into their offerings. According to our report, Driving Loyalty: Market Insights on Car Rentals & Reward Programs, that opportunity could be as much as $20 billion. As more loyalty programs across industries introduce car rentals as an earning, redemption, or booking option, more consumers will recognize the value of leveraging their loyalty points for their car rental activity, further cementing loyalty platforms as a major distribution vector.

Summer Pricing Surge… in Some Places

Despite uneven booking volumes in 2025, prices similarly indicate varying demand levels in different markets.

Whether consumers book their rental cars through their loyalty programs, an OTA, or an airline, consistent with broader market pricing patterns, they can expect to pay more in the summer than in other months due to increased leisure travel. However, despite uneven booking volumes in 2025, prices similarly indicate varying demand levels in different markets. Platform data show that car rental prices in the second quarter began their seasonal upswing, but individual regions rose faster than others.

In the United States, the average price for a 5-day trip in July booked between January and June 2025 was $531, an 8% decline from the same period last year. In Europe, the same trip duration averaged EUR 264, a slight (1%) increase over 2024. While each of these average price figures were up relative to comparable periods in the first quarter, the differential between North America and European destinations reflects declining inbound U.S. demand and rising desirability of top European destinations as summer approaches, including Lisbon (EUR 206, +19% YOY). Similarly, rising prices at city center, non-airport locations in Europe (+6% YOY) compared to airport rentals (unchanged) suggests higher intra-European demand rather than transatlantic traffic.

Average Price of a 5-Day Rental in July, booked between January–June 2025

Spain – Mallorca

€168

-5% YoY

Spain – Malaga

€140

-8% YoY

Portugal – Lisbon

€206

+18% YoY

Europe

€264

+1% YoY

North America

$531 (€450)

-5% YoY

U.S. dollars converted to Euros for accurate comparison

Looking Ahead

Much like our first quarter market monitor, this data snapshot shows a global car rental market that is entering into the summer travel season with some momentum, but also some headwinds. EV demand increased quarter to quarter, but it remains below multi-year highs. The use of alternative payment methods, including Apple Pay and BNPL, is on the upswing as brands recognize the conversion and revenue opportunities associated with meeting consumers’ preferences for ways to pay, but the North American market remains tethered to traditional credit cards. Loyalty programs are emerging as a critical distribution channel but the proportion of programs offering redemption options for car rentals still lags, leaving a sizable opportunity on the table.

Our verdict? Cautious optimism. Threats are real and progress is incremental, but in general, we see a car rental market that’s healthy and resilient heading into summer. And that means that car rental capabilities continue to be a competitive advantage for travel brands, OTAs, and loyalty programs, if they also meet consumer demand for technological convenience and choice.

Download the Q2 2025 Market Monitor infographic for a quick summary of the key insights or contact us to discuss how introducing or expanding car rentals can impact your business.

CarTrawler powers car rental and mobility solutions for many of the world’s leading travel brands and loyalty programs, creating connected travel experiences through the most comprehensive network of car rental suppliers worldwide. Our Connect Platform scales to meet shifting consumer and traveller demand, giving airlines, OTAs, and loyalty programs the flexibility to offer trusted, reliable mobility services anywhere at any time. Handling over 1 billion passengers and bookings annually—nearly a quarter of the world’s car rental market—CarTrawler is a leader in the global travel industry.

Data Sources and Analysis

Except where otherwise noted, the data presented in this Q2 2025 Car Rental Market Monitor reflects car rental activity from CarTrawler’s extensive travel partners and supply partners. While representing a focused segment of the global car rental market, the findings have been analyzed and extrapolated to offer CarTrawler’s interpretation of broader industry trends and the direction of the wider market.

© All Rights Reserved, CarTrawler 2025.

All rights reserved. This report may not be reproduced or redistributed in whole or part, in any form or by any means, including photocopying and recording, without the prior written permission of CarTrawler, the copyright owner. CarTrawler accepts no liability whatsoever for the actions of third parties in this respect. If any unauthorized acts are carried out in relation to this copyright work, a civil claim for damages may be made and/or a criminal prosecution may result.

The information in this report was prepared by and on behalf of CarTrawler. CarTrawler has made every effort to use reliable, up-to-date, and comprehensive information and analysis but all information is provided without warranty of any kind, expressed or implied. CarTrawler disclaims any responsibility to update the information or conclusions in this report. CarTrawler accepts no liability for any loss arising from any action taken or refrained from as a result of information contained in this report, or any reports or sources of information referred to herein, or for any consequential, special, or similar damages even if advised of the possibility of such damages. This report may not be sold under any circumstances.