The 2018 CarTrawler Ancillary Yearbook reveals ancillary revenue is the elixir that enables airlines to offer headline grabbing low fares

Sep 27, 2018

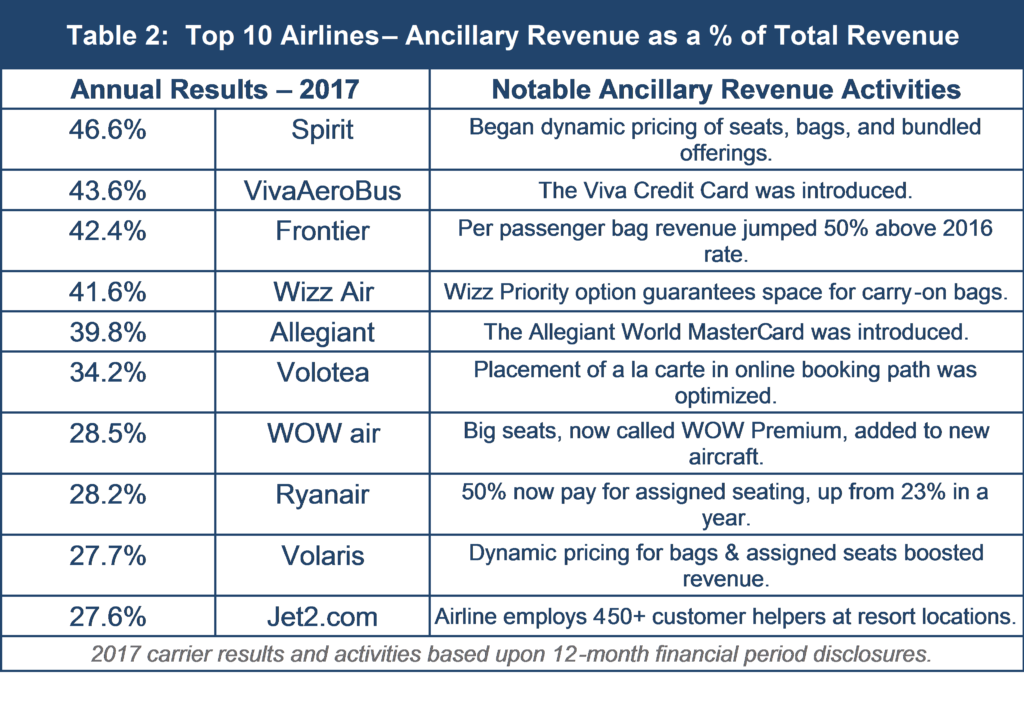

It’s a logical corollary that airlines with low average fares achieve the best “percent of total revenue” results. Table 2 below, taken from The 2018 CarTrawler Yearbook of Ancillary Revenue identifies the leading low cost carriers in the world. This measurement demonstrates the capacity to generate a major share of ancillary revenue through a la carte activities. It’s also a reliable year-over-year indicator because it removes the factor of global currency fluctuations.

The 2018 CarTrawler Yearbook of Ancillary Revenue: Download here.

Top performer: Spirit

Ancillary revenue as a portion of total revenue appears to have reached a ceiling of 50 percent with the top producer being Spirit at 46.6%. Spirit’s total ticket revenue was approximately $110 per passenger for 2017. Of this amount, about $51 (or 46.6%) would qualify as ancillary revenue. However, it must be noted that it’s easier for a non-global airline to achieve this high rate because the underlying passenger fares are lower for short- and medium-haul travel.

Michael O’Leary has remarked throughout his tenure as CEO of Ryanair that fares could someday be zero; with consumer air travel costs limited to a la carte fees and other ancillary revenue. Over time, that objective eluded Ryanair, with other airlines currently doing much better – as you’ll see from the table above.

WOW air: A low cost ancillary revenue powerhouse with global reach

The other airlines in the Top 10 Airlines list above are similar in this regard, with one significant exception – WOW air. During 2017, its Iceland-based route network stretched from San Francisco to Israel. For 2018, the carrier will reach even greater distance when it adds India. The privately held airline disclosed its results directly to IdeaWorksCompany for inclusion in this Yearbook. WOW air is obviously an ancillary revenue powerhouse with results significantly above other long-haul LCCs; AirAsia X and Scoot don’t appear in this top 10 table.

All top ten airlines on this list are all low fare champions.

These airlines have introduced vast numbers of lower income consumers to the wonder of flight. Evidence of this stunning public service achievement abounds. VivaAeroBus and Volaris actively compete with bus lines in Mexico. Ryanair and Wizz Air provide an economical lifeline for many workers in Western Europe to visit families living in former Soviet-bloc countries. WOW air has made headlines in the US with $99 fares to Europe which allow practically anyone to become a globe-hopping tourist. More traditional carriers would not embrace this low fare mission without a competitive push from LCCs.

Bottom line: Ancillary revenue is the elixir that enables airlines to offer headline grabbing low fares, while maintaining a predictable revenue flow from the sale of optional extras.