CarTrawler trends: the year in data

Feb 2, 2021

While 2020 was a year full of surprises, CarTrawler’s sophisticated data capabilities meant that we were well-placed to keep on top of rapidly changing market trends as they happened. From our data, we observed a variety of new trends throughout the year which included: a shift to domestic travel, longer trip durations, varying advance times, and knee-jerk reactions to travel on the back of relaxed government restrictions. All of these trends point to the fact that there remains significant pent-up demand for travel, even during these uncertain times and this bodes well for the industry as we can finally see the vaccine on the horizon.

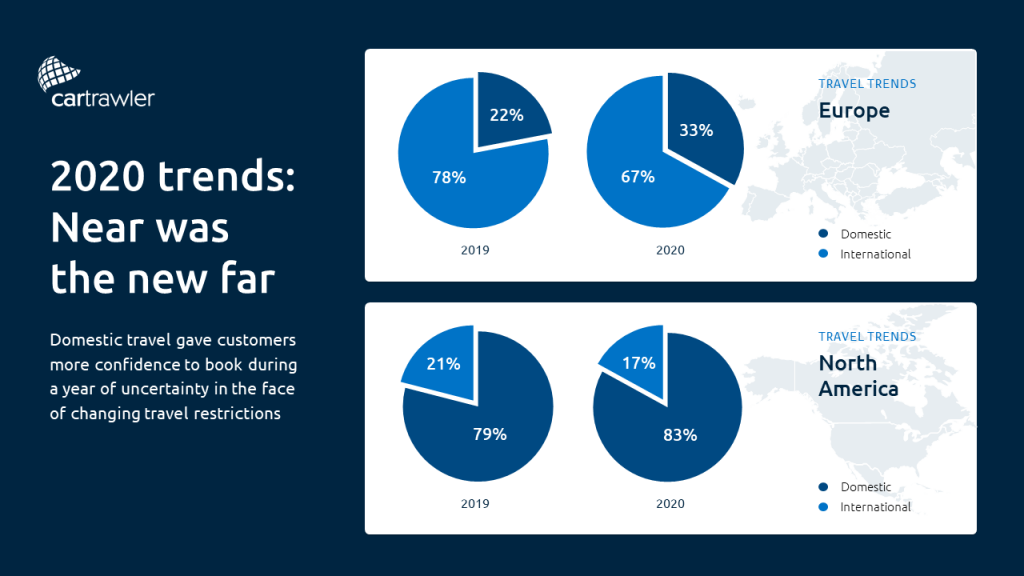

Near was the new far

Customers increasingly turned to domestic travel as an alternative to the closure of borders and stricter travel restrictions. Travel within a customer’s own country was favoured during a time when restrictions regularly fluctuated, and this ‘near is the new far’ mentality gave customers greater certainty to book and travel. We saw significant increases in domestic business when comparing 2019 with 2020:

- Europe: Domestic travel across European countries increased by +11pp from 2019

- North America: In a market where domestic tourism is already the norm, domestic travel increased by +4pp

People took longer trips

From the very beginning of the pandemic, average rental days increased significantly across the world and we continued to see the trend of longer trip durations throughout the year. This is partly due to a combination of people choosing to travel for longer periods of time when they do travel, coupled with reduced business travel volumes which normally would have brought far shorter trips into the mix.

Booking advance times varied

In Europe and North America during the early stages of the pandemic, we saw booking advance times materially increase, likely owing to the anticipation that we would be through the worst by late summer.

As 2020 progressed however we saw the advance times drop significantly, signalling that customers were waiting until closer to their date of departure to book. This was undoubtedly a response to a more cautious approach customers were now taking in order to mitigate any macro factors which would result in cancellation.

There were knee-jerk reactions to travel

Throughout the Summer and into Winter, customers were highly sensitive to the introduction of stricter restrictions. For example, in November the UK announced a brief respite in COVID restrictions in which a Canary Islands travel corridor was permitted. This change in policy resulted in a WOW growth that was up +186pp vs the previous week’s growth from Source UK to destination Spain. This illustrated the pent-up demand to travel and the eagerness to book once customers have more certainty.