CarTrawler Car Rental Market Monitor: Vol. 1 2025

Apr 28, 2025

Introduction

Our new Car Rental Market Monitor series provides a snapshot of the current state of the car rental and mobility marketplace. Based on CarTrawler data from global car rentals, these snapshots highlight trends, market demand, and customer behaviours, offering valuable insights – and revealing opportunities – for businesses across the travel and transportation sectors.

A Look at the Car Rental Marketplace Q1 2025

The car rental industry continues to be shaped by changing consumer preferences and macroeconomic factors. Persistently high inflation rates both in North America and Europe influence transportation habits, while equally persistent supply chain challenges impact rental fleet sizes and procurement. Additional uncertainty posed by the new US tariff regime is creating additional challenges and opportunities for both renters and suppliers. Some of the major car rental companies have seen their stock prices jump as analysts predict boosts to fleet value and a shift from car ownership to “usership,” while increasing segments of consumers are exploring alternative mobility options even as fuel prices remain stable.

While car rentals have continued to see rising booking volumes and stable prices in some regions, the industry is facing upward pressure on rental prices due to rising fleet acquisition and repair costs. These price increases are likely to be more noticeable in the medium to long term, potentially affecting demand in certain segments, though currently, strong overall consumer demand remains. Despite these headwinds and general upheaval, our data paints a portrait of a healthy global car rental marketplace that mirrors the broader transportation and travel sectors. As the leading B2B technology provider of car rental solutions to the global travel sector, we’re presenting this industry-wide data to help illuminate the consumer trends driving this performance, with a focus on convenience, immediacy, and sustainability.

Our data reveals a market that is not only resilient but also actively adapting to meet new customer expectations. From payment technologies to vehicle preferences, today’s renters are signalling clear priorities that any travel or non-travel brand offering car rental booking capabilities to its customers would do well to heed.

Sustained Growth Mirrors Travel Industry Recovery

Total bookings have grown significantly since January 2023 and continued their upward trajectory into 2025, with March bookings increasing YOY.

This growth correlates directly with the global travel industry’s recovery and expansion. While booking volumes follow predictable seasonal patterns, peaking during summer months before declining toward winter holidays, the overall trend remains positive. While new partnerships established in 2024 may contribute to the growth indicated in this snapshot, the overall trend demonstrates growth despite regional variations in booking patterns across Europe, the UK, and North America.

Prices Stabilise But Will Never Return to 2019 Levels

After years of volatile pricing, the car rental market shows signs of stabilisation. Average rental prices have decreased steadily from EUR 312 (GBP 263 / USD 347) per booking in March 2023 to approximately EUR 262 (GBP 221 / USD 291) in March 2025, and the average price growth relative to 2019 levels has tapered off commensurately. This is despite significant growth in large and luxury category rental volumes, with “luxury” rentals increasing by 81% between March 2024 and March 2025 and SUVs experiencing a 51% volume increase over the same period. While we expect to see some increased inflationary pressure on car prices in the US if auto tariffs hold and supplier margins are challenged by increased maintenance and repair costs, the data in this snapshot indicates relative price stability.

Despite variations in rental type, mild two-year declines but overall price stabilisation appears consistent across major markets. The following represent average prices across all trips per market, according to the CarTrawler database:

- Europe: Prices declined from EUR 289 to approximately EUR 238 between March 2023 and March 2025.

- UK: Prices dropped from EUR 301 (GBP 253) in March 2023 to approximately EUR 236 (GBP 199) by March 2025.

- North America: March prices fell from EUR 332 (USD 369) in 2023 to EUR 284 (USD 316) in 2025.

Predictably, prices continue to exhibit seasonal fluctuations, with peak rates occurring during the high-demand summer vacation months of June and July—a pattern that persists despite overall moderation

in pricing.

Electric Vehicle Rentals: Growth, Peaks, and What’s Next

The multi-year increase in demand for electric vehicle rentals indicates an industry embracing innovation and consumers who are eager for flexibility and sustainable choices in their mobility options, even as intra-year demand for EV rentals has stalled somewhat.

While EV bookings have increased over time, growing from a mere 0.6% of total rentals in January 2023 to 4% by March 2025, they peaked at 5% during late 2024. Despite this levelling off, the growth dramatically outpaces the more modest increase in hybrid vehicle rentals, which grew from 0.4% to 1.2% of total sales by March 2025. This trend aligns with the wide-scale shifts in the automotive market, reflecting the global expansion of electric vehicles from 26 million cars on the road in 2022 to an estimated 40 million in 2023.

North America leads in electric demand, with EV rentals currently accounting for 5% of total rental sales, following an impressive 8% during the summer of 2024. Meanwhile, hybrid vehicles show stronger adoption in European and UK markets, currently representing 1.6% and 1.4% of bookings, respectively.

Changing Consumer Booking Behaviors

Consumer booking patterns reveal evolving preferences for flexibility and immediacy. The average lead time between booking and travel has decreased from 49.54 days in January 2024 to 41.98 days in March 2025. This metric follows seasonal variations, with longer planning horizons at the beginning of the year giving way to more spontaneous decisions during summer and holiday periods.

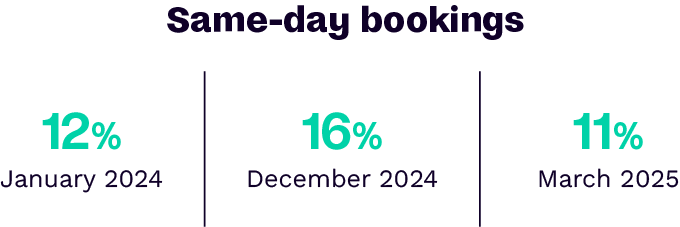

The shortest booking windows—same-day bookings—demonstrate similar cyclical patterns, reflecting a balance between advance planning and the need for flexibility during peak travel seasons, as well as the growth of “everyday” or non-travel-related car rentals:

Device preferences remain relatively stable, with desktop bookings increasing slightly from 61% in March 2024 to 63% by March 2025. However, a subtle shift toward mobile platforms is evident in the UK, where mobile usage increased from 42% to 43% over the same period.

Alternative Payments Gain Momentum

Traditional payment methods are losing ground as consumers embrace alternatives. Credit card dominance has declined from 90% of global bookings in March 2024 to 85% by March 2025, with regional variations highlighting different adoption rates.

While North American rentals remain firmly tied to credit cards (99% of bookings), European markets show greater diversification, with credit card usage dropping from 89% to 86% between March 2024 and March 2025. The UK market demonstrates even greater payment innovation, with credit card bookings decreasing from 86% to 83% over the same period, while Apple Pay gains significant traction. Altogether, alternative payments now account for nearly 15% of global transactions processed through the CarTrawler platform.

Alternative payment methods, including Apple Pay, Google Pay, PayPal, and buy-now-pay-later (BNPL) services like Klarna, exhibit consistent growth, reflecting consumers’ desire for convenient payments and contemporary financial tools that align with their digital lives. The relatively slow rate of adoption of these payment methods in the US market is partially attributable to the fact that most US bookings are post-paid – reserved online but paid for at the rental counter. As more US-based rental providers prioritise alternative payment methods in their ecommerce transactions, we expect adoption to grow concurrently.

Looking Ahead

This data snapshot reveals that the state of the car rental market across the first quarter of 2025 is strong. While seasonal patterns and regional preferences persist, clear signals point toward a customer base increasingly drawn to technological advances, personalised experiences and the flexibility of car rentals as an alternative to car ownership. Travel and loyalty brands that offer car rental capabilities and recognise and adapt to these emerging consumer priorities—particularly around vehicle electrification, booking flexibility, and payment diversification—will likely capture greater market share in their competitive sectors.

Our verdict? Cautious optimism. Threats are real and progress is incremental, but in general, we see a car rental market that’s healthy and resilient heading into summer. And that means that car rental capabilities continue to be a competitive advantage for travel brands, OTAs, and loyalty programs, if they also meet consumer demand for technological convenience and choice.

CarTrawler powers car rental and mobility solutions for many of the world’s leading travel brands and loyalty programs, creating connected travel experiences through the most comprehensive network of car rental suppliers worldwide. Our Connect Platform scales to meet shifting consumer and traveler demand, giving airlines, OTAs, and loyalty programs the flexibility to offer trusted, reliable car rental and mobility services anywhere at any time. Handling over 1 billion passengers and bookings annually—nearly a quarter of the world’s car rental market—CarTrawler is a leader in the global travel industry.

Download the Vol. 1 2025 CarTrawler Car Rental Market Monitor infographic for an overview of the insights or contact us to discuss how introducing or expanding car rentals can impact your business.

Data Sources and Analysis

The data presented in this Q1 Car Rental Market Monitor reflects car rental activity from CarTrawler’s extensive travel partners and supply partners. While representing a focused segment of the global car rental market, the findings have been analysed and extrapolated to offer CarTrawler’s interpretation of broader industry trends and the direction of the wider market.

Currency conversions are based on live mid-market exchange rates as of May 13, 2025: 1 EUR = 0.8417 GBP and 1 EUR = 1.1110 USD. Figures have been rounded to the nearest whole number for clarity and consistency.