Forecasting the Future of Travel: 2025 Trend Report

May 2, 2025

Introduction

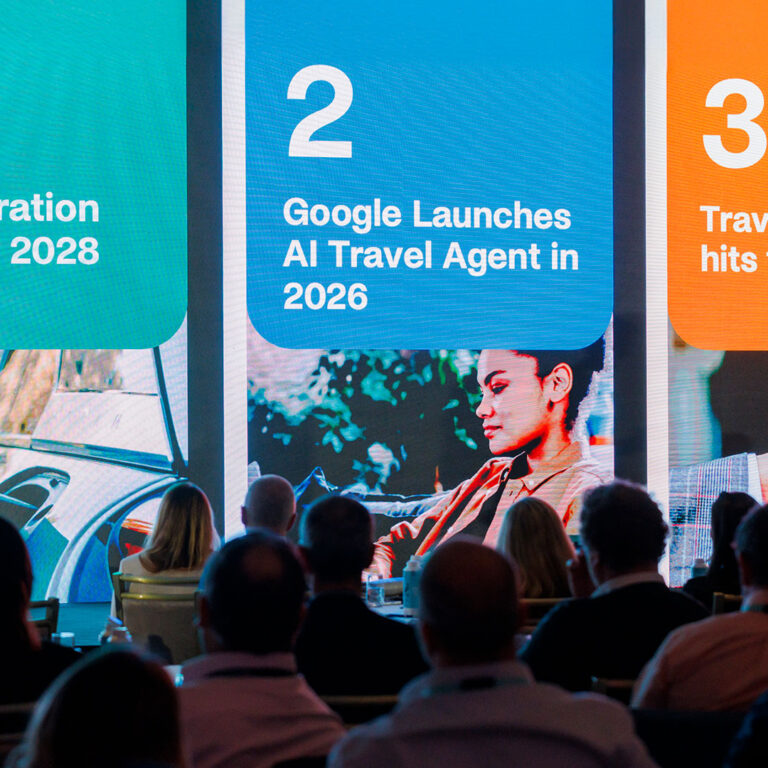

At Connect25, an annual conference that brings together some of the biggest global players in the airlines, car rental, and mobility industries, CarTrawler’s Chief Revenue Officer, Gavin Sweeney, took the stage for his much-anticipated keynote, “Forecasting the Future of Travel: The Next Chapter.” Speaking to a room full of thought leaders, Gavin laid out three bold new calls for 2025 and beyond.

2025 is not just another chapter in travel’s recovery—it’s a reinvention. Consumer preferences are shifting fast, technology is rewriting how we plan and experience travel, and industry norms are under pressure from rising costs and an uncertain macroeconomic outlook. At the intersection of airlines, car rental suppliers, and travellers, CarTrawler offers a unique vantage point into what’s coming next. And what’s coming? Massive change—and fast.

Gavin outlined three key trends that will define the travel landscape in 2025 and beyond.

Trend 1:

EV Rentals Shift Gears – Penetration to Triple by 2028

After plateauing at just 3.5% in 2024, we predict that EV penetration in car rentals is set to accelerate past 10% by 2028.

The Shift From Curiosity to Commitment: Despite Early Enthusiasm for EVs, Adoption Stumbled in 2024

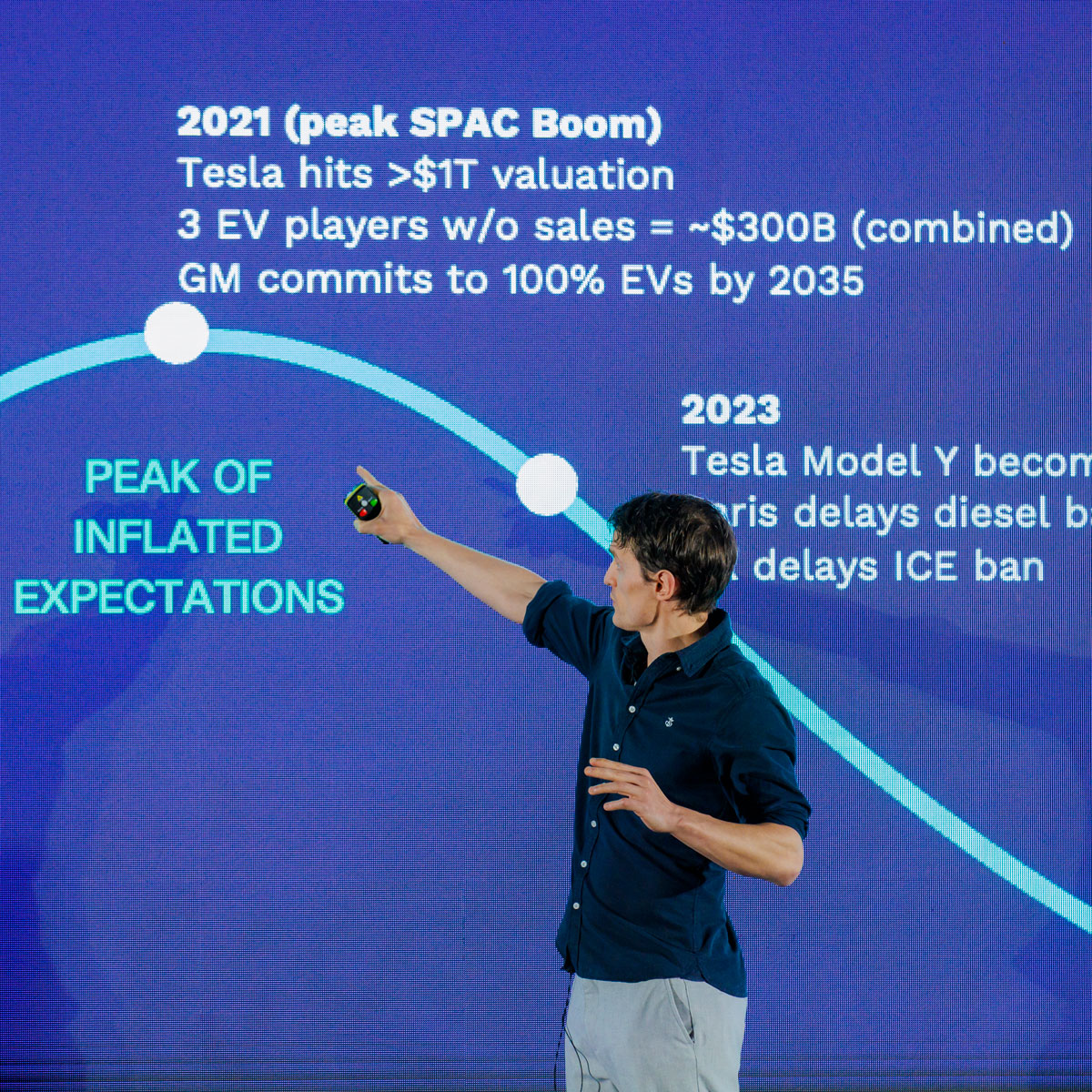

We’ve gone in 2-3 years, from Tesla reaching a $1t valuation, becoming the most sold car in the world, GM committing to 100% product on non-emission vehicles to EV bankruptcies, pullbacks from government subsidies and infrastructure commitments, EV depreciation challenges and material write downs in EV valuations for our car rental suppliers.

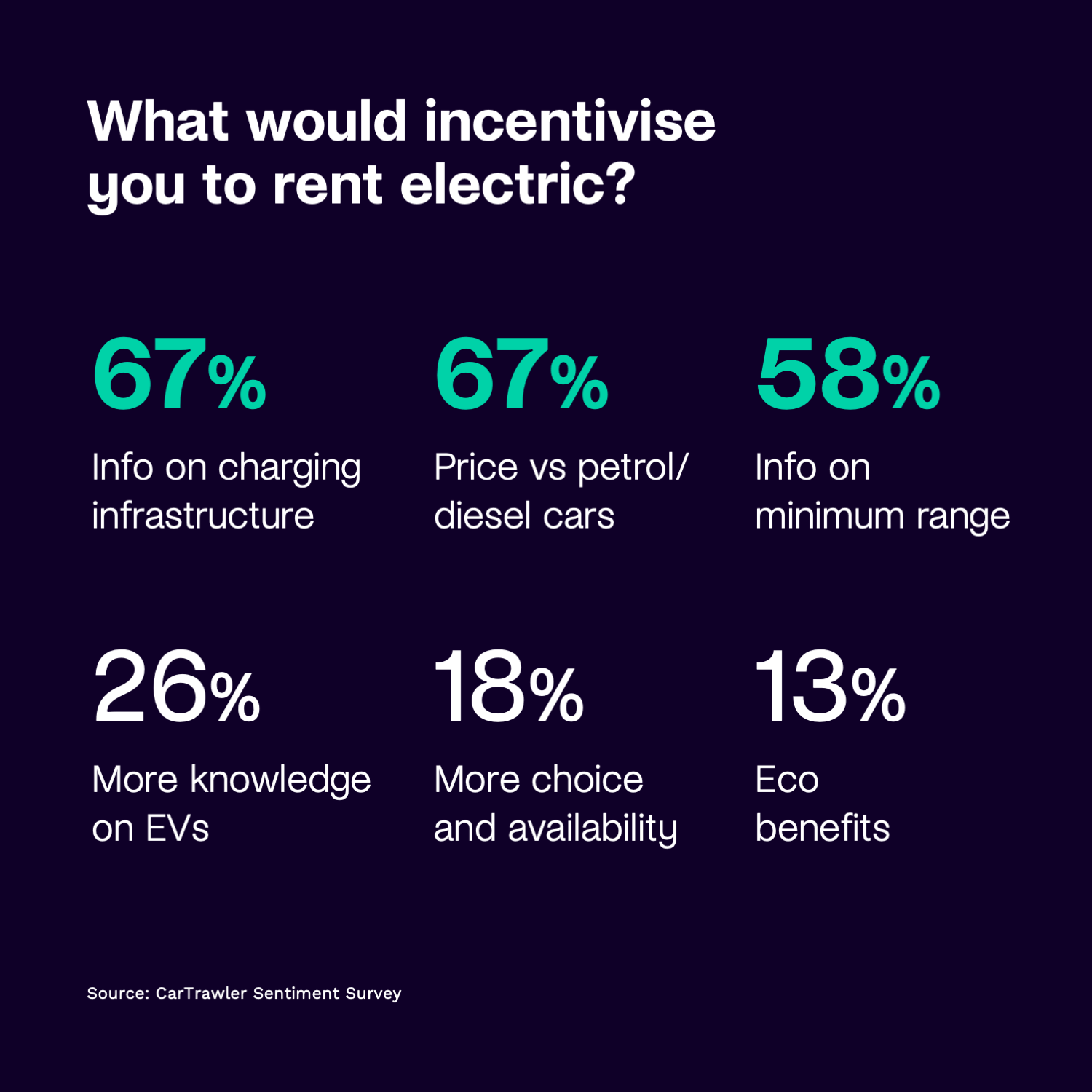

But travellers, especially younger ones, haven’t turned away—they’ve just been waiting for the experience to catch up. According to our latest CarTrawler consumer sentiment survey across our UK and US customer base, penetration in the EV car rental market is still low across both markets. But we know consideration, particularly around younger generations is high—customers are interested.

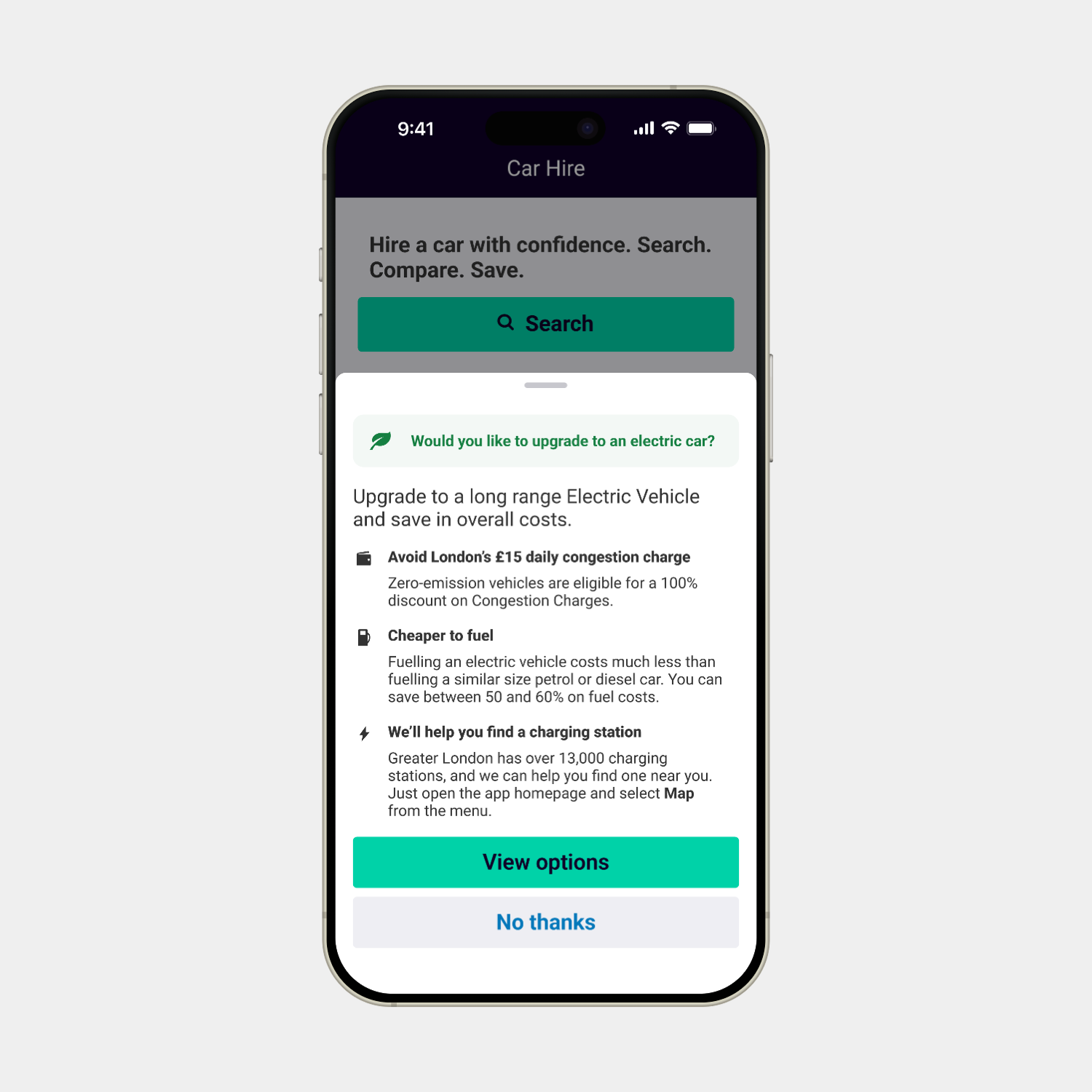

The Barriers Are Breaking: Charging Infrastructure Information

One of the key barriers to widespread EV adoption has been a lack of transparency around charging infrastructure. We’ve been working closely with our supply and travel partners to improve visibility and transparency regarding charging station locations and availability. This is a critical area we are committed to testing and evolving, ensuring that travellers have the information they need to make confident decisions when renting EVs.

EV Pricing vs. Petrol and Diesel Cars

Pricing has long been a significant barrier, with many customers unwilling to pay a premium for sustainable EV options. However, this barrier is rapidly breaking down. Over the past year, the premium traditionally charged for EVs has closed significantly, with some prices even becoming comparable to petrol and diesel vehicles. Furthermore, the influx of EVs from China, particularly from manufacturers like BYD, is exerting downward pressure on EV pricing. In 2025, the launch of the BYD Seagull in Europe—a low-cost EV priced under $10k in China—signals that affordable EV options are becoming more accessible to a broader customer base.

Range Anxiety

Range anxiety, another long-standing barrier to EV adoption, is also being addressed with significant breakthroughs in battery technology. BYD’s recent announcement of a 5-minute charge that offers 250 miles of range is a game-changer, potentially eliminating range anxiety for good. These advances in battery tech are poised to offer travellers the convenience they expect, making EVs a more practical option for a larger segment of the market.

Why It Matters for Travel?

EV rentals are no longer just a niche. They’re becoming a differentiator—a way for travel brands to align with sustainability expectations while staying competitive on price. And those who lead here will win the loyalty of tomorrow’s traveller.

Trend 2:

Google’s AI Travel Agent Will Arrive in 2026

On average, people spend around two months researching their next adventure—whether it’s searching for inspiration or fine-tuning every detail. That’s a lot of time spent scrolling through blogs, watching videos, reading reviews, and trying to make the perfect choice before finally booking. Increasingly we are seeing people looking to fast track the booking journey. Two of our partners, easyJet and Jet2 continue to benefit from this through the growth experienced in their UK holiday/package offering.

The Next Wave of Loyalty

As we think through the next wave of loyalty in travel, it’s clear that this shift in consumer behaviour will play a key role. The focus will not merely be on offering customer points, rewards, enhanced servicing, or discounts. Instead, it will be about delivering what people truly value: time and certainty. Firstly, the time saved in booking travel more quickly and easily. Secondly, the confidence that a brand knows them well and makes smart, hyper-personalized choices aligned with their preferences.

We believe that this shift toward providing time and certainty could fuel the next wave of travel loyalty. With the right technology and customer understanding, this flywheel effect could drive unprecedented engagement. And, in this next phase, Agentic Generative AI will play a key role in powering this transformation, and Google will lead the charge.

AI Knows You Better Than You Think

Imagine an AI agent that:

- Knows your schedule, budget, dietary preferences, and travel history.

- Has seen every confirmation email you’ve received.

- Understands your content habits.

- Suggests holidays not just based on trends—but on you.

It’s like having a travel-savvy assistant who’s been shadowing your life for a decade.

It’s not science fiction. It’s 2025.

Why Google Will Move Quickly into AI-Powered Travel

Google faces a significant risk to its core search revenue due to the rise of agentic generative AI tools like ChatGPT Operator. In early 2025, OpenAI launched this AI-driven booking assistant and announced partnerships across eCommerce and travel — including Booking.com, Google’s largest global ad spender, with an annual spend of $3.9 billion, or roughly 2% of Google’s entire Search revenue.

This development represents a serious threat: if consumers begin planning and booking travel directly through conversational AI platforms instead of searching via Google, the entire travel ad ecosystem could be disrupted. In response, CarTrawler predicts that Google will accelerate the launch of its own AI-powered travel assistant by 2026 — leveraging its unmatched data advantage to retain market share and stay at the centre of the digital travel journey.

Trend 3:

Travel Tech M&A Will Hit a 10-Year High

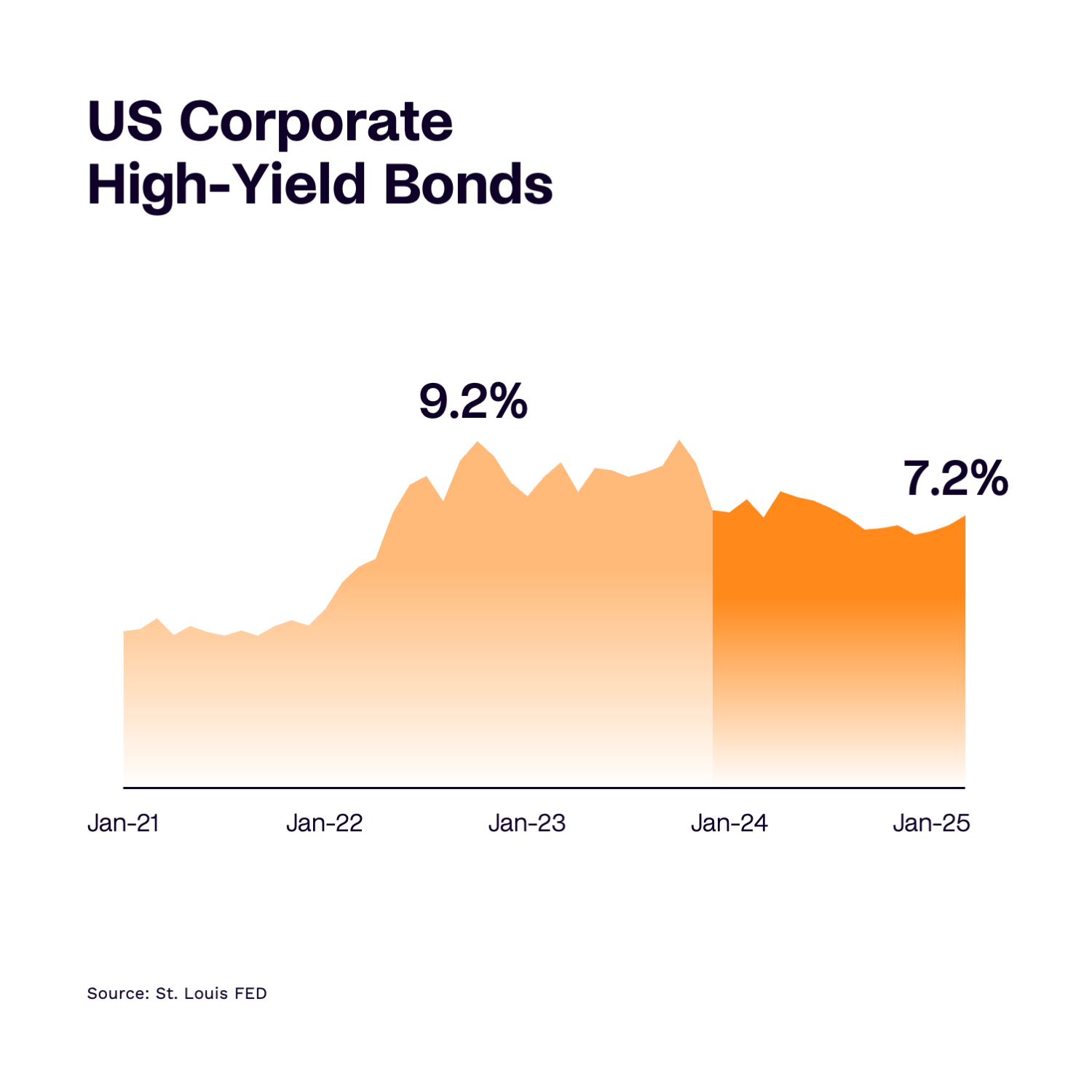

The Travel Tech M&A market saw a material slowdown in activity post 2021, with increased regulatory scrutiny, tightening financial conditions, and waning investor and executive confidence all impacting. And although recent geopolitical tensions have represented a setback, we believe the medium-term conditions are favourable for a resurgence in Travel Tech M&A.

Post-2021 Slowdown

From 2021 onwards, several factors dampened M&A activity in the travel tech space. First of all, tightening financial markets made capital harder to access for many companies. Also, regulatory pressures from both the US and EU increased significantly, with high-profile mergers like JetBlue and Spirit and Booking.com and eTravelli falling under scrutiny. Additionally, CEO confidence dropped to its lowest levels in over a decade by the end of 2022, with many industry leaders uncertain about the future trajectory of the sector. However, recent macroeconomic shifts are now setting the stage for a major rebound in M&A activity.

Why 2026 Will Be the Year of Transformation?

Several key macroeconomic factors indicate that 2026 will be a defining year for travel tech M&A, with a confluence of improved financial conditions, looser regulatory frameworks, and a renewed focus on building future-ready platforms:

1. The Return of Capital

Strategic players and OTAs are currently sitting on $55 billion in cash and equivalents, ready to invest in consolidation opportunities. The IPO market is also showing signs of recovery, with companies like HotelBeds leading the way. This availability of capital is likely to fuel a new wave of M&A activity.

2. Regulatory Shifts

After the regulatory bottlenecks of 2021–2023, newly adopted frameworks in both the US and EU are becoming more pragmatic. These evolving approaches are expected to ease the burden on dealmakers and foster a more favorable environment for mergers and acquisitions. This regulatory shift, combined with a marked increase in CEO confidence observed in Q1 2025, signals that the sector is poised to advance with large-scale consolidation.

3. The Stakes Are Higher Now

Today, consolidation is no longer just about achieving efficiency—it’s about building scalable, future-proof platforms that can thrive in an increasingly AI-driven and personalized travel environment. Companies need to control high-quality, structured data, maintain end-to-end control over the booking funnel, and have the agility to quickly deploy new consumer experiences. Those who lack scale or capital will be forced to merge in order to remain competitive.

Summary:

2025 Signals a Rewriting of the Travel Rulebook

2025 isn’t just about bouncing back from previous disruptions; it’s about fundamentally reshaping the travel experience. As technology accelerates and consumer expectations evolve, companies will need to be agile and forward-thinking to stay ahead.

Key Trends to Watch:

-

EV Rentals: What was once a plateau in the market is now poised for significant growth, with penetration set to triple by 2028 as technology, infrastructure, and pricing align.

-

AI Planning: Consumers are ready to move from travel overload to effortless booking, with AI-driven platforms like Google’s upcoming travel assistant set to simplify the entire planning process.

-

M&A Activity: After years of pause, the travel tech M&A landscape is heating up, driven by cash reserves, looser regulations, and the growing need for scalable platforms that can compete in an AI-driven future.

As Gavin Sweeney highlighted during his keynote, “2025 is not just another chapter in travel’s recovery—it’s a reinvention. The pace of change is quickening, but those ready to adapt will find themselves at the forefront of this transformation.”